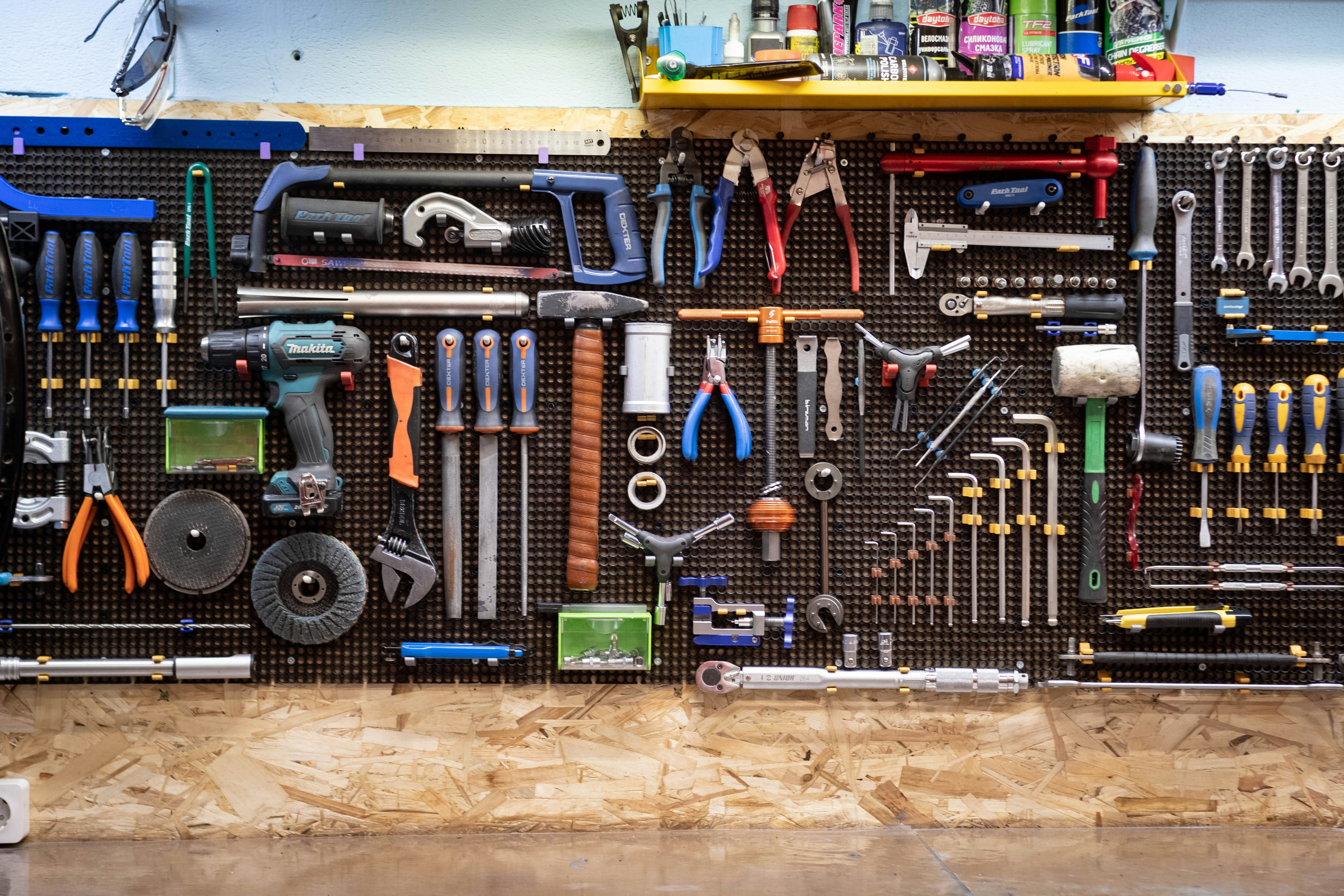

Add New Tools to Your Marketing Toolbox—And Learn How to Use Them Well

Marketing automation has become an essential tool in the credit union marketer’s toolbox. Like any powerful tool, it delivers real value—but only when used with purpose and precision. Whether you're building stronger member relationships or streamlining operations, automation equips your team with new capabilities to do more with less.

But here’s the catch: just having the tools isn't enough. Success depends on how you use them.

This article outlines the key benefits of marketing automation for credit unions, common challenges to watch for, and practical strategies to get more from your new toolbox.

Why Credit Unions Are Investing in Marketing Automation

Credit union marketing teams are often small and resource-constrained. With the right tools, even lean teams can run sophisticated campaigns, scale their efforts, and build deeper connections with members—without overextending their bandwidth.

Marketing automation is no longer a luxury. It’s a modern must-have.

Core Capabilities That Drive Results

These are just a few of the powerful new tools, that when used together, become a well-stocked, high-performance toolbox for any marketing team.

- Routine Task Automation – Free up staff by automating emails, follow-ups, reminders, and social media scheduling.

- Personalization and Segmentation – Use internal and external data to tailor content by member segment or behavior.

- Lead Nurturing and Scoring – Track engagement across channels and move leads through the funnel more efficiently.

- Full Lifecycle Visibility – Monitor the member journey from first interaction through long-term engagement and retention.

- Automated Feedback – Deploy surveys and collect real-time input to identify opportunities and address issues early.

Benefits for Credit Unions

Think of marketing automation as both a tactical and strategic upgrade. It's about efficiency—but it's also about craftsmanship: building more thoughtful, personalized, and scalable campaigns.

- Stronger Engagement – Timely, relevant content increases member satisfaction and loyalty.

- Operational Efficiency – Automation reduces manual work and increases output without increasing headcount.

- Improved Targeting – Better segmentation leads to higher campaign performance and more relevant messaging.

- Higher Conversion Rates – Automated workflows allow for consistent lead nurturing across all touchpoints.

- Scalability – Grow without losing consistency or overwhelming your team.

- Lower Long-Term Costs – With the right setup, automation pays for itself quickly through time saved and higher performance.

- More Actionable Insights – Real-time reporting and analytics improve campaign optimization and decision-making.

Common Challenges—and How to Fix Them

Even the best tools require proper setup, maintenance, and skill. Here are the most common issues credit unions face—and how to address them.

Inaccurate or Unclean Data

Problem: Poor data leads to mistargeted campaigns and wasted effort.

Solution: Implement a structured data hygiene program that includes:

- Data entry standards and validation

- Regular de-duplication

- Archiving outdated records

- Ongoing audits and normalization

Problem: Disconnected systems create inefficiencies and lost opportunities.

Solution: Choose tools that integrate—like HubSpot—or consider a unified platform to streamline data and workflows.

Impersonal Messaging

Problem: Automation without personalization feels robotic.

Solution: Use behavioral triggers, dynamic content, and smart segmentation. The more context you have, the more relevant your messaging becomes.

Overuse of Automation

Problem: Too many messages = member fatigue.

Solution: Prioritize relevance. Build journeys with intent, monitor feedback, and refine often.

Ineffective Lead Nurturing

Problem: One-size-fits-all workflows don’t reflect real member needs.

Solution: Build tailored workflows for key use cases:

- New member onboarding

- Loan application follow-up

- Dormant account re-engagement

Final Thought

Marketing automation gives you more tools than ever before—but mastery comes from knowing when and how to use them. Think of it as evolving from a basic toolkit to a full workshop—capable of tackling everything from routine tasks to complex, data-driven campaigns.

Don’t let your tools gather dust. Build smart, optimize often, and continue adding new capabilities to stay ahead.

The future of credit union marketing is already here—and it’s time to get to work.

.png?width=352&name=Featured%20PR%20Image%20(1).png)